Essential Actions for Successful Credit Repair You Required to Know

Essential Actions for Successful Credit Repair You Required to Know

Blog Article

Understanding How Credit Score Repair Work Functions to Boost Your Financial Wellness

Recognizing the technicians of credit report repair work is crucial for any individual looking for to boost their financial wellness. The process encompasses identifying errors in credit scores reports, contesting mistakes with credit report bureaus, and bargaining with financial institutions to attend to arrearages. While these activities can considerably influence one's credit history, the journey does not end there. Establishing and maintaining audio financial methods plays a similarly essential role. The question remains: what particular approaches can individuals use to not just correct their credit standing yet likewise make sure long-term economic security?

What Is Credit Rating Repair?

Credit repair refers to the process of enhancing a person's credit reliability by resolving inaccuracies on their credit rating report, discussing financial debts, and taking on better economic behaviors. This multifaceted strategy intends to boost an individual's credit rating, which is a critical consider securing car loans, credit history cards, and favorable rates of interest.

The debt repair procedure commonly begins with a thorough evaluation of the individual's credit record, enabling the recognition of any mistakes or discrepancies. As soon as inaccuracies are pinpointed, the specific or a credit history repair work professional can initiate disagreements with credit bureaus to remedy these concerns. Furthermore, discussing with creditors to settle outstanding financial obligations can additionally boost one's economic standing.

Moreover, taking on prudent financial techniques, such as timely bill payments, decreasing credit use, and preserving a diverse credit history mix, contributes to a much healthier credit scores account. In general, credit scores repair work offers as a vital approach for people looking for to gain back control over their monetary wellness and secure better loaning opportunities in the future - Credit Repair. By participating in credit rating repair, individuals can lead the way towards accomplishing their financial objectives and enhancing their general top quality of life

Typical Credit Rating Report Mistakes

Errors on credit rating reports can considerably affect a person's credit rating, making it important to understand the common sorts of errors that may arise. One widespread concern is wrong personal info, such as misspelled names, incorrect addresses, or wrong Social Protection numbers. These mistakes can result in complication and misreporting of creditworthiness.

An additional common mistake is the reporting of accounts that do not belong to the individual, typically as a result of identity theft or clerical mistakes. This misallocation can unfairly decrease a person's credit history. Furthermore, late payments may be incorrectly taped, which can happen because of settlement handling errors or wrong reporting by lending institutions.

Credit scores limitations and account equilibriums can additionally be misstated, leading to a distorted sight of an individual's debt usage proportion. Understanding of these typical errors is important for efficient credit report monitoring and repair work, as addressing them immediately can aid individuals preserve a healthier monetary profile - Credit Repair.

Actions to Conflict Inaccuracies

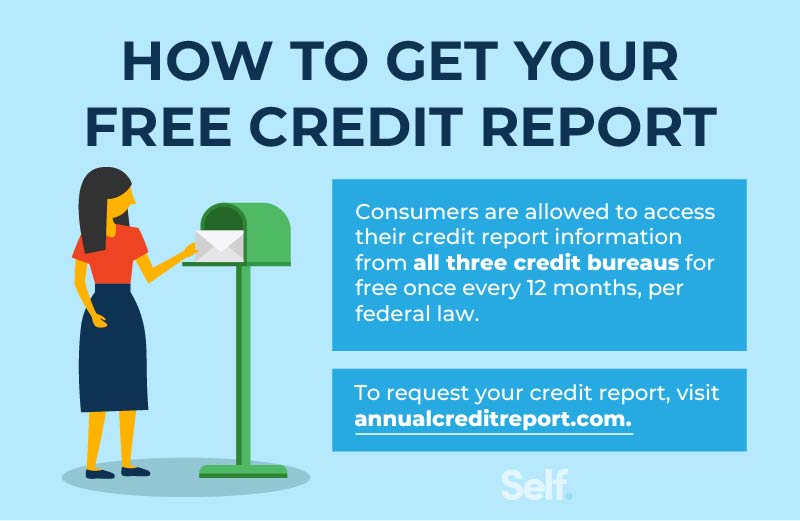

Disputing inaccuracies on a credit rating report is a vital process that can help recover a person's credit reliability. The first step includes acquiring a current copy of your credit rating report from all 3 significant credit rating bureaus: Experian, TransUnion, and Equifax. Testimonial the record carefully to determine any kind of errors, such as wrong account information, equilibriums, or repayment histories.

Next off, launch the conflict process by contacting the relevant debt bureau. When sending your conflict, plainly detail the inaccuracies, offer your proof, and include personal recognition information.

After the conflict is submitted, the credit bureau will certainly examine the insurance claim, normally within 30 days. Maintaining exact records throughout this process is necessary for efficient resolution and tracking your credit scores wellness.

Building a Strong Credit Rating Profile

Building a strong credit profile is crucial for protecting desirable monetary chances. Continually paying credit card costs, finances, and various other responsibilities on time is important, as my website repayment history substantially impacts credit rating scores.

Moreover, maintaining low credit history application ratios-- preferably under 30%-- is crucial. This means keeping credit scores card balances well below their limits. Branching out debt kinds, such as a mix of revolving debt (debt cards) and installment finances (vehicle or home finances), can also boost credit history accounts.

Frequently keeping an eye on credit reports for inaccuracies is equally crucial. Individuals ought to examine their credit history reports a minimum of every year to identify discrepancies and challenge any mistakes without delay. Furthermore, avoiding excessive credit rating questions can prevent possible negative effect on credit report.

Long-term Benefits of Credit History Repair

Additionally, a more powerful debt account can help with much better terms for insurance policy costs and even influence rental applications, making click for more info it much easier to protect real estate. The emotional advantages should not be overlooked; people who successfully repair their credit history usually experience minimized anxiety and boosted self-confidence in handling their financial resources.

Verdict

To conclude, credit history repair service works as a crucial mechanism for enhancing financial health. By determining and disputing mistakes in credit records, individuals can fix mistakes that negatively affect their credit rating. Establishing audio monetary practices further adds to constructing a robust credit rating account. Inevitably, reliable credit score repair service not just assists in access to better financings and reduced passion rates yet also cultivates long-lasting economic security, thereby advertising total financial well-being.

The lasting benefits of credit rating repair work expand far beyond simply enhanced credit score ratings; they can significantly boost a person's total monetary wellness.

Report this page